Why 5G is Critical for the PCB Industry: Technical Disruption and Market Opportunities

By:PCBBUY 05/27/2025 16:21

Introduction: The Era of 5G and Its Transformative Impact

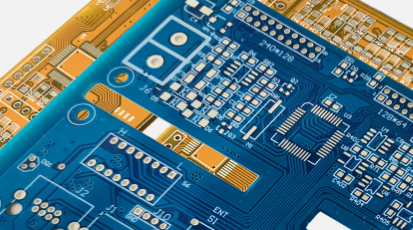

The advent of 5G technology is reshaping the global digital landscape, promising ultra-high-speed connectivity (up to 20 Gbps), ultra-low latency (<1 ms), and massive device connectivity. As the backbone of modern electronics, printed circuit boards (PCBs) play a pivotal role in enabling 5G infrastructure and devices. This article explores the technical drivers, industry challenges, and market opportunities presented by 5G, supported by data and insights from leading industry analyses.

1. Technical Drivers of 5G: Why PCBs Are Central to Its Success

1.1 High-Frequency Operation and Advanced Materials

5G operates in millimeter-wave (mmWave) bands (24–77 GHz), necessitating PCB materials with low dielectric constant (Dk) and dissipation factor (Df) to minimize signal loss. Traditional FR4 materials (Dk ~4.5) are inadequate at these frequencies, while PTFE-based laminates (Dk ~3.5) or ceramic-filled composites (Dk ~3.0) offer superior performance.

|

Material |

Dielectric Constant (Dk) |

Dissipation Factor (Df) |

Suitable Frequency Range |

|

FR4 |

4.2–4.8 |

0.02–0.05 |

Up to 10 GHz |

|

PTFE |

3.0–3.5 |

<0.002 |

10–50 GHz |

|

Ceramic Composite |

2.8–3.2 |

<0.001 |

>20 GHz |

Source: Compiled from [1], [3], and [4].

1.2 MIMO and Beamforming: Complexity in Antenna Design

5G’s Massive MIMO technology requires PCBs to accommodate densely packed antenna arrays (e.g., 64×64 elements). This demands:

-

High-precision manufacturing: Tolerances tighter than ±0.05 mm for trace width and spacing.

-

Layer counts: Increase from 4–16 layers (4G) to 20–40 layers (5G) for high-density interconnects.

-

Controlled impedance: Ensuring ±5% impedance tolerance across layers to prevent signal reflection.

1.3 Signal Integrity and EMI Shielding

At mmWave frequencies, even minor parasitic capacitance or inductance can degrade signals. Solutions include:

-

Coplanar waveguides (CPWs): Reducing crosstalk in multilayer boards.

-

Embedded passives: Integrating resistors/capacitors directly into PCB layers to save space.

-

Multilayer shielding: Alternating ground planes and signal layers to block electromagnetic interference (EMI).

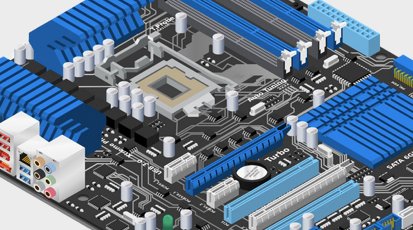

2. Market Disruption: How 5G Reshapes PCB Demand

2.1 Exponential Growth in Base Station Deployment

5G’s mmWave bands have limited coverage range, necessitating smaller, denser base stations. Industry estimates suggest:

-

4G vs. 5G stations: 5G requires ~10× more base stations than 4G (from 5M to 50M globally).

-

PCB content per station:

o 4G: 2–4 high-layer PCBs (e.g., 16 layers).

o 5G: 6–12 PCBs, including Massive MIMO arrays (20+ layers) and high-frequency radio boards.

2.2 Device Miniaturization and High Density

Smartphones, IoT modules, and automotive radar systems demand:

-

HDI (High-Density Interconnect) PCBs: With via pitches <50 μm and line widths <10 μm.

-

Flexible and rigid-flex PCBs: To accommodate complex shapes in compact spaces (e.g., foldable phones).

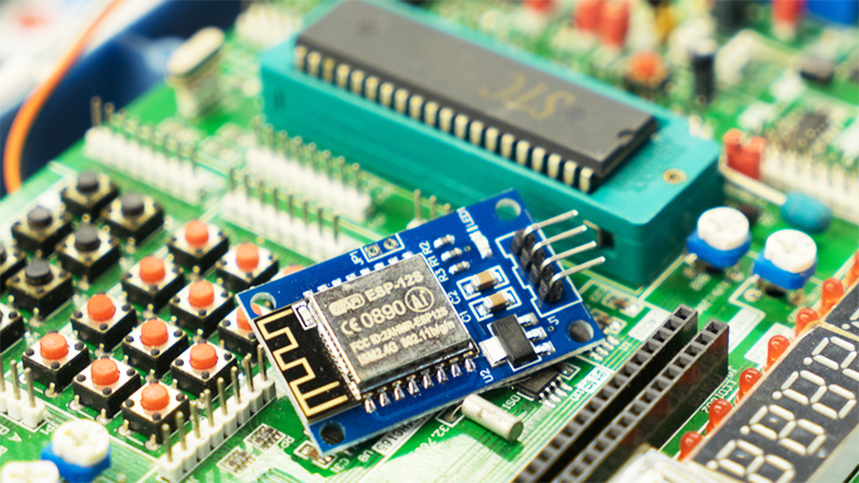

3. Technical Challenges and Innovations

3.1 Thermal Management

5G devices dissipate higher power densities (e.g., 10 W/cm² in baseband units), requiring:

-

High-thermal-conductivity materials: Metal-core PCBs (MCPCBs) with thermal conductivity >2 W/m·K.

-

Active cooling: Embedded microfluidic channels for heat dissipation.

3.2 Manufacturing Tolerances

The shift to finer features mandates:

-

Laser direct imaging (LDI): Replacing traditional photomasks for sub-10 μm trace resolution.

-

Automated optical inspection (AOI): Detecting micro-cracks or shorts in HDI boards.

3.3 Supply Chain Resilience

Key challenges include:

-

Material supply: PTFE and ceramic materials are costly and sourced from niche suppliers.

-

Geopolitical risks: Reliance on Chinese manufacturers for 50%+ of global high-layer PCB capacity.

4. Economic Implications and Market Forecasts

4.1 Market Size and Growth

-

Global PCB market: Projected to grow from 73billion(2023)to73billion(2023)to95 billion by 2028, driven by 5G.

-

5G-specific PCB demand: Accounting for ~30% of communications sector revenue by 2027.

4.2 Regional Leadership

-

Asia: Dominates with 75% of production capacity, led by Taiwan, China, and South Korea.

-

Western manufacturers: Specialize in high-end niche markets (e.g., aerospace, medical).

5. Future Roadmap: Innovations and Sustainability

5.1 Next-Generation Technologies

-

Sub-6 GHz and mmWave integration: PCBs supporting dual-band operation.

-

AI-driven design: Machine learning for optimizing layoutand material selection.

5.2 Sustainability Initiatives

-

Halogen-free laminates: Reducing environmental impact.

-

Recycling advances: Recovery rates of rare metals (e.g., copper, silver) improved via hydrometallurgy.

Conclusion: PCBs as the Bedrock of 5G Innovation

The 5G revolution demands unprecedented precision, reliability, and scalability from PCBs. While technical challenges persist, they are catalyzing innovation in materials, manufacturing, and design—positioning the PCB industry as a cornerstone of tomorrow’s connected world.

References

[1] Prismark Partners. (2023). Global PCB Market Report.

[2] Skyworks. (2020). 5G Mobile Devices: RF Front-End Challenges.

[3] Cadence Design. (2022). Signal Integrity in High-Speed PCBs.

[4] IPC Association. (2021). Standards for High-Frequency PCB Design.

[5] Ministry of Industry and Information Technology, China. (2023). 5G Network Deployment White Paper.

Industry Category